With all the news coverage on the recent “Great Recession”, you might think bursts of speculation and the subsequent collapse in prices are unique to the modern age. They’re not.

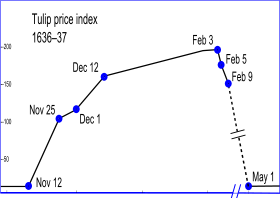

During the latter half of 1636 Tulip prices in Holland skyrocketed. By the peak of the bubble in February 1637, a single tulip bulb was selling for more than the average laborer made in an entire year. There was a strong belief that tulip prices would only continue to rise. Then, just as suddenly, the tulip market collapsed. Those who had bought in at the top were left destitute wondering where their fortunes had gone. Sound familiar?

As much as economists would like to explain markets with clean, mathematical formulas, there is a human element that can never be fully predicted. The cycle of booms and busts is linked to human psychology as much as actual macroeconomic conditions. The older I get the more I think the efficient-market hypothesis is a pipe dream and real markets are far more complex and unpredictable than its creators would have envisioned.